A budget is one of the most powerful financial tools you can use to take control of your money. It helps you track your income, control your expenses, and work toward your financial goals. But the challenge many people face is creating a budget that actually works—one that’s realistic, easy to follow, and keeps them on track.

In this guide, we’ll explore different budgeting methods, tools, and tips to help you build a budget that fits your lifestyle and helps you achieve financial success.

Why Budgeting is Important

Many people think of budgeting as restrictive, but in reality, it gives you financial freedom. Instead of wondering where your money went at the end of the month, you’ll have a clear plan for where it should go.

Benefits of Budgeting:

✔ Gives You Control: Helps you avoid overspending.

✔ Reduces Financial Stress: Eliminates the paycheck-to-paycheck cycle.

✔ Increases Savings: Helps you set aside money for emergencies and long-term goals.

✔ Helps You Pay Off Debt Faster: Allows you to allocate extra money toward debt repayment.

Now, let’s dive into different budgeting methods so you can choose the best one for you.

- Popular Budgeting Methods

The 50/30/20 Budget (Best for Beginners)

The 50/30/20 rule, popularized by Senator Elizabeth Warren, is a simple, percentage-based budgeting method that divides your income into three categories:

50% Needs: Essential expenses like rent, groceries, utilities, transportation, and insurance.

30% Wants: Non-essentials like entertainment, dining out, travel, and shopping.

20% Savings & Debt Repayment: Emergency fund, retirement savings, investments, and extra debt payments.

How It Works:

- Calculate your after-tax income.

- Allocate 50% to needs, 30% to wants, and 20% to savings or debt.

- Adjust as needed based on your financial goals.

✅ Why It Works: Simple, flexible, and easy to maintain.

❌ Downside: May not work for those with high debt or living in expensive areas.

Zero-Based Budgeting (Best for Maximum Control)

With zero-based budgeting (ZBB), every dollar of your income is assigned a purpose so that your income minus expenses equals zero.

How It Works:

- List your total monthly income.

- Assign every dollar to expenses, savings, or debt repayment.

- Adjust each category until your total income matches your total expenses.

Example:

| Category | Amount |

| Rent/Mortgage | $1,200 |

| Utilities | $150 |

| Groceries | $300 |

| Transportation | $200 |

| Entertainment | $150 |

| Savings | $500 |

| Debt Payments | $300 |

| Total Expenses | $2,800 |

| Income | $2,800 |

✅ Why It Works: Ensures you maximize every dollar.

❌ Downside: Requires detailed tracking, which can be time-consuming.

The Envelope Method (Best for Cash-Based Budgeting)

The envelope system is a cash-based budgeting method where you divide your spending into physical envelopes for different categories.

How It Works:

- Withdraw cash for budgeting categories like groceries, entertainment, gas, and dining.

- Place the cash into labeled envelopes.

- Spend only what’s in each envelope—when it’s empty, you stop spending.

✅ Why It Works: Prevents overspending and builds discipline.

❌ Downside: Less convenient for digital transactions.

Best Budgeting Tools & Apps

Technology makes budgeting easier with apps that track spending, categorize expenses, and automate savings.

YNAB (You Need a Budget)

Uses zero-based budgeting to assign every dollar a job.

Helps users pay off debt and build savings.

Syncs with bank accounts and provides real-time tracking.

Best for: People who want a hands-on budgeting system.

- Mint

Automatically tracks spending by linking to bank accounts.

Creates customized budgets and alerts for overspending.

Provides free credit score tracking.

Best for: Beginners who want automatic expense tracking.

- Every Dollar

Developed by Dave Ramsey, focuses on zero-based budgeting.

Simple interface with easy expense tracking.

Best for: Those following the debt snowball method.

- Pocket Guard

Automatically tells you how much you can safely spend after accounting for bills and savings.

Great for avoiding overspending.

Best for: People who need a quick budgeting snapshot.

- Steps to Create a Monthly Budget That Works

No matter which budgeting method you choose, follow these steps to make your budget effective.

Step 1: Calculate Your Income

Include all sources:

Salary (after tax)

Freelance or side hustle income

Rental or passive income

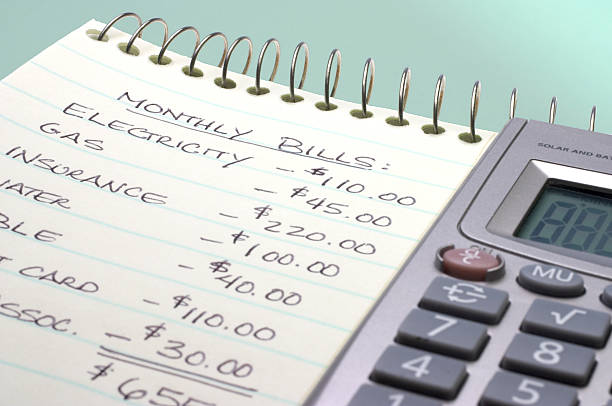

Step 2: Track Your Expenses

Review bank statements, receipts, and transaction history to understand your spending habits.

Step 3: Choose a Budgeting Method

Decide whether the 50/30/20 rule, zero-based budgeting, or envelope system works best for you.

Step 4: Set Financial Goals

Short-term: Save for a vacation or emergency fund.

Long-term: Pay off debt, invest, or buy a house.

Step 5: Cut Unnecessary Expenses

Cancel unused subscriptions.

Cook at home instead of eating out.

Use coupons and cashback apps.

Step 6: Automate Savings and Bill Payments

Set up auto-transfers to savings and investment accounts.

Schedule bill payments to avoid late fees.

Step 7: Review & Adjust Your Budget Monthly

Budgets aren’t static—they need adjustments based on changes in income or expenses.

- Common Budgeting Mistakes to Avoid

🚫 Being Too Strict – A budget should allow some flexibility.

🚫 Forgetting Irregular Expenses – Plan for annual expenses like car registration or holiday shopping.

🚫 Not Tracking Spending – Use an app or spreadsheet to monitor progress.

🚫 Ignoring Emergency Funds – Always save for unexpected costs.

🚫 Failing to Adjust – Life changes, so should your budget.

Final Thoughts: Take Control of Your Finances

Creating a budget that actually works is about balance, consistency, and flexibility. Whether you use the 50/30/20 rule for simplicity, zero-based budgeting for precision, or the envelope method for discipline, the key is sticking with it and making adjustments as needed.

💡 Start today by choosing a method, tracking your spending, and setting goals. Over time, budgeting will become second nature, leading you to financial security and freedom.